The profitability scale of painting tools industry is directly proportional to the growth map of the paints and coatings sector, given that the former encompasses the necessary equipment to deploy paints and coatings across numerous end-use sectors such as those of automotive, manufacturing, construction, and consumer goods. One of the most pivotal pointers to be taken note of, when debating over the prominence of painting tools market, is that this business is an inherent vertical of the paints and coatings domain. In effect, the renewed dynamism that painting tools industry is being characterized by currently, can be rightly attributed to the demand for paints in numerous professional sectors. The requirement for painting equipment such as rollers, masking tapes, brushes, knives, scrapers, spray guns, and trays varies in consonance with the business in question. In consequence, it can be inferred that that extensive growth rate of the aforementioned sectors certainly has a proportional impact on painting tools industry size.

Defined by a moderately fragmented competitive landscape, painting tools market stands to accrue massive monetary gains in the forthcoming years, pertaining to the extensive deployment of paints and coatings in luxury cars, high-rise residential and commercial buildings, swanky malls and multiplexes, machinery, furniture, and consumer goods. The developments underlining the paints fraternity certainly do have a mammoth impact on painting tools industry outlook. Outlined below is a competitive profiling of painting tools industry, aptly highlighting the contributions made by three major companies toward the revenue share.

Dunn-Edwards Corporation | Developments impacting painting tools industry trends

Dunn-Edwards Corporation has held a respectable position in painting tools market since long, having been a painting supplies major for almost a century now. It was only post the advent of the new millennium though, that the company explored its commercialization potential and carved out a brand presence for itself. Soon after, the firm inked a reputed partnership with Paint America, that helped Dunn-Edwards expand its regional presence and its product portfolio, both of which eventually had a considerable impact on painting tools industry.

More than half a decade earlier, in 2011, Dunn-Edwards launched a new premium interior hybrid enamel paint portfolio that was traditionally an oil-based paint, endowed with the expected features, however, it was basically manufactured using waterborne alkyd technology, giving the painted surface a glassy appearance. Christened Aristowall, this product was immediately deployed across the construction sector, for interior walls, cabinets, baths, cabinets, etc. Its robust adoption across the residential and commercial sectors took painting tools industry by storm, gradually augmenting its revenue share for the year in question.

In 2016, the painting tools market major witnessed one of its biggest pacts – the company signed a deal with the Japan-based Nippon Paint, one of largest paint manufacturers of the nation, in a bid to help the latter expand its presence across the United States. The acquisition is likely to have a rather positive influence on the U.S. painting tools industry share, given that the amalgamation of two major paint behemoths would necessitate the requirement of a massive volume of painting tools across myriad end-use sectors.

Orkla Group | Developments impacting painting tools industry trends

The Orkla Group, a Norwegian conglomerate headquartered in Oslo, is essentially a company operating in consumer goods, however, the firm profoundly demands the requirement of customized paints and painting equipment for its products such as refrigerators and washing machines. In a bid to enhance its own consumer goods portfolio and brainstorm a range of personalized, aesthetically pleasing products, in the year 2012, Orkla made it to the headlines for acquiring the Jordan Group, a regional painting tools industry leader. Jordan, being the third-largest manufacturer of painting tools in the Europe belt, reportedly helped Orkla expand its consumer base both, within as well as outside the home country. With this acquisition, Orkla set the trend of harnessing the expertise of local players to strengthen its core business, which subsequently influenced the growth map of Europe painting tools market.

In 2016, Orkla acquired the famed Bromsgrove-based LG Harris, one of the most reputed participants partaking in UK painting tools industry share. The takeover, apparently valued at a price of GBP 55 million, was aimed at expanding the presence of Orkla House Care in the UK. In addition, given that LG Harris is a world leader in the DIY sector, its acquisition by Orkla would lead to Orkla House Care earnestly accelerating its equipment range across the DIY fraternity, thereby providing a significant impetus to the product landscape of Europe painting tools market.

Harbor Freight Tools | Developments impacting painting tools industry trends

As per experts, if a measuring scale would be deployed to assess the expansion rate of companies partaking in painting tools industry share, the California-based retailer, Harbor Freight Tools would undeniably emerge victorious. The year 2017 has certainly been triumphant for the painting tools market leader, on the grounds that the company has announced the launch of multiple stores since the onset of the year. Harbor’s store launches have been forecast to prompt other painting tools market giants to adopt the strategy of tapping the retail space, which would positively garner appreciable acclaim in the years ahead, substantially influencing the revenue share of the overall painting tools industry. The company’s retail space expansions would not only increase its sales volume, but would unquestionably strengthen its position in U.S. painting tools market.

- At the onset of the year 2017, in January, Harbor Freight Tools launched an 18,000 square foot store in Alexander City. The store has apparently been forecast to generate USD 4 million in sales.

- Toward the end of Q2 2017, the painting tools industry major launched a store in Kileen, with the intention of expanding its foothold furthermore across the U.S. It has in fact, been touted to be the 63rd store in Texas.

- The month of September was seemingly an impactful one for the painting tools market retailer. The company opened up stores in Missouri and Virginia, and announced the opening of another retail space in Sioux Falls, South Dakota.

Harbor’s massive expansion policy highlights the significance of product popularity prevalent at grass root levels. In consequence, it is expected that other behemoths in painting tools industry emulate similar tactics to expand their consumer pool across major geographies, increase product sales, and subsequently consolidate their presence across this business sphere.

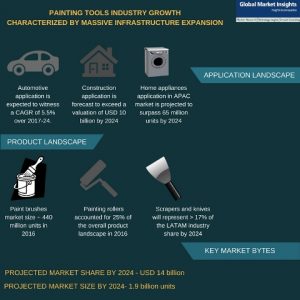

The commercialization ratio of painting tools industry, to a marked extent, is dependent on the introduction of cutting-edge products and their eventual popularity and sales pitch. This vertical forms an essential fragment of core businesses such as manufacturing and construction, given that these sectors demand the requirement of painting tools and equipment to quite an extent. The fact that these domains have been depicting a massive rise in expansion lately, underline two major aspects – firstly, the growth of these spheres would invariably have a considerable impact on the revenue graph of the overall painting tools industry. Secondly, this exponential growth would eventually necessitate the demand for an innovative range of painting tools, equipped with advanced technology, pertaining to changing preferences of the end-use domains. In all likelihood, the profitability quotient of painting tools industry may surmount elevated levels in the ensuing years, pertaining to the widespread application gamut of this business space and the commendable efforts undertaken by major companies toward augmenting its revenue share. Having already been pegged at a valuation of more than USD 9.3 billion in 2016, painting tools market size has been forecast to be worth more than USD 14 billion by 2024.

Global Market Insights, Inc. has a report titled “Painting Tools Market Size By Product (Brushes, Rollers, Scrapers, Knives, Trays, Spray Gun, Masking Tapes), By Application (Construction [Residential, Commercial, Industrial], Automotive, Appliances, Furniture, Industrial Machineries & Equipment, Packaging) Industry Analysis Report, Regional Outlook (U.S, Canada, Germany, UK, France, Italy, Spain, Poland, Russia, China, India, Japan, South Korea, Malaysia, Indonesia, Thailand, Brazil, Mexico, Argentina, Saudi Arabia, UAE, Iran, Iraq, Egypt, South Africa), Growth Potential, Price Trends, Competitive Market Share & Forecast, 2017-2024” available at

https://www.gminsights.com/industry-analysis/painting-tools-market